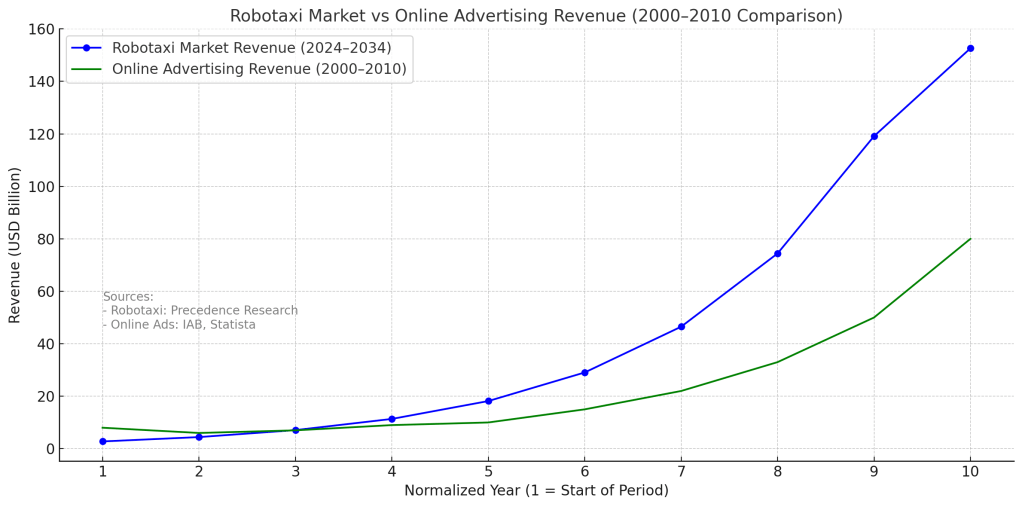

In the world of technological disruption, every era witnesses an industry with exponential growth that reshapes the economy. The early 2000s were defined by the meteoric rise of online advertising, a sector that surged from $8 billion in 2000 to $120 billion by 2010, fundamentally transforming how businesses reached their audiences. Fast forward to 2024, and we are at the dawn of another revolution: the robotaxi market.

Projections for the robotaxi industry are staggering. By 2034, the market is expected to reach $188.91 billion, growing at a pace that rivals, and in many ways surpasses, the early growth of online advertising. In this blog, we compare the growth trajectories of these two groundbreaking industries and explore why companies like Waymo (a Google subsidiary) and Tesla are poised to dominate the robotaxi revolution.

The Numbers: A Decade of Growth

Online Advertising (2000–2010)

- 2000 Revenue: $8 billion

- 2010 Revenue: $120 billion

- Key Players: Google, Yahoo, Facebook

- Growth Drivers: Widespread internet adoption, search engine optimization (SEO), and the rise of digital media.

The online advertising market experienced consistent growth as more businesses shifted their budgets from traditional to digital channels. Companies like Google, leveraging platforms such as AdWords, became synonymous with this revolution, turning search engines into marketing powerhouses.

Robotaxis (2024–2034)

- 2024 Revenue: $2.77 billion

- 2034 Revenue: $188.91 billion

- Key Players: Waymo (Google), Tesla, Cruise (GM), and Uber.

- Growth Drivers: Advances in autonomous vehicle technology, reduced transportation costs, and growing consumer adoption of shared mobility services.

The robotaxi market is expected to grow exponentially, driven by advancements in AI, electric vehicle (EV) infrastructure, and regulatory support for autonomous transportation. By Year 7 (2030), the market is projected to surpass $100 billion, a milestone that took online advertising nearly 10 years to achieve.

Why Robotaxis Are Growing Faster

- Technological Leaps: The rapid development of AI and autonomous driving technology has accelerated the timeline for robotaxi adoption. Companies like Waymo and Tesla have invested billions in R&D, ensuring that their systems are both reliable and scalable.

- Market Demand: With urbanization increasing globally, there is a growing demand for efficient, cost-effective, and eco-friendly transportation solutions. Robotaxis address these needs by reducing congestion and emissions.

- Cost Efficiency: Once operational, robotaxis significantly reduce costs associated with human drivers, fuel, and maintenance, making them an attractive alternative to traditional ride-hailing services.

- Network Effects: Similar to how Google’s search engine dominated through its network effects, robotaxi platforms are expected to consolidate market share by leveraging data to optimize routes, pricing, and customer experience.

The Dominant Players: Waymo and Tesla

Waymo (Google)

As a pioneer in autonomous vehicle technology, Waymo has an early-mover advantage. Its extensive data from real-world testing, combined with Google’s expertise in AI and mapping, positions it as a leader in the robotaxi market. With services already operational in select U.S. cities, Waymo is setting the standard for what’s possible.

Tesla

Tesla’s approach to robotaxis is uniquely aggressive. Elon Musk’s vision of a global fleet of autonomous Teslas—operated by owners as part of a shared network—could disrupt the traditional ride-hailing and car ownership models. Tesla’s vertically integrated strategy, from manufacturing to software, ensures it can scale quickly and efficiently.

Comparing Growth Trajectories: Online Ads vs. Robotaxis

While online advertising revolutionized marketing, its growth was relatively linear compared to the exponential curve projected for robotaxis. Key differences include:

- Starting Point: Online ads began at $8 billion in 2000, a significantly higher base than robotaxis’ $2.77 billion in 2024.

- Acceleration: Robotaxis are projected to grow faster, hitting $188.91 billion within 10 years, compared to $120 billion for online ads over the same timeline.

- Industry Maturity: Online ads benefited from decades of groundwork in digital media. Robotaxis, on the other hand, are entering an era of unprecedented technological acceleration.

What This Means for the Future

The rise of robotaxis signals a shift in how we think about transportation, technology, and urban mobility. As Waymo, Tesla, and others race to capture market share, the next decade will witness fierce competition and innovation. For investors, policymakers, and consumers, this is more than just a new market; it’s the beginning of a transportation revolution.

Much like how Google dominated the digital advertising space, companies that can combine technology, data, and user experience will emerge as the leaders of the robotaxi era. Waymo and Tesla are already paving the way, but as history has shown, disruption often brings surprises.

The question isn’t whether robotaxis will dominate, but how quickly they will transform our cities and economies. One thing is clear: the road ahead is full of opportunities.